I often see beginners asking about travel hacking and rewards points. Most people answer by tossing out their favorite credit card and the conversation ends. No one explains what points are, how to determine their value, how they’re earned, or how to spend them. I thought it’d be helpful to share a full walkthrough of how I decide which credit cards to open for travel rewards points. In this example, I’ll share how to book 10 nights at a 3 star hotel for free.

Step 1: Pick Your Vacation Destination

The first thing I typically do before opening any credit cards is decide where I want to go. I usually pull up the AllegiantAir route map to see what destinations they fly to from my local airport. Allegiant flights are incredibly cheap and I can almost always find a $20-30 discount making my roundtrip airfare less than $100. So instead of collecting points to pay for an inexpensive flight, I tend to collect points to pay for expensive hotels.

You can do the same for Frontier, Spirit or other low cost airlines depending on what is favorable for you. If there aren’t any low cost airlines near you, skip this step and pick a destination. In this example, we’ll use St. Petersburg, FL.

Step 2: Find Point-Friendly Hotels

The second step is to pull up Google maps and enter “hotels near St. Petersburg, FL”. I do this to find out what hotel chains are in the area. Taking a quick look at the results, I can see that Hilton, Holiday Inn and Marriott have several options. From previous experience, I know these hotels have point programs, so I narrow in on these choices.

If I have a preference towards any of them because of location or amenities, I make note of them. For the sake of this example, let’s say I like the Holiday Inn Express St. Petersburg – Madeira Beach.

Step 3: Understand Point Values

Next I head over to the Holiday Inn website for the Madeira Beach hotel so that I can find out how many points it will cost to stay there. The first thing I notice is that IHG owns Holiday Inn (as evidenced by the url www.ihg.com). This means we’re no longer looking for Holiday Inn points, but IHG points. I enter some dates and select “Rewards Nights” from the Rate Preference drop down.

When the results appear, I can see that it will cost me 17,500 IHG points per night for this hotel. Assuming I want to go for a week (6 nights), I need 105,000 points.

Step 4: Find Sign-up Bonuses that Offer the Highest Point Value

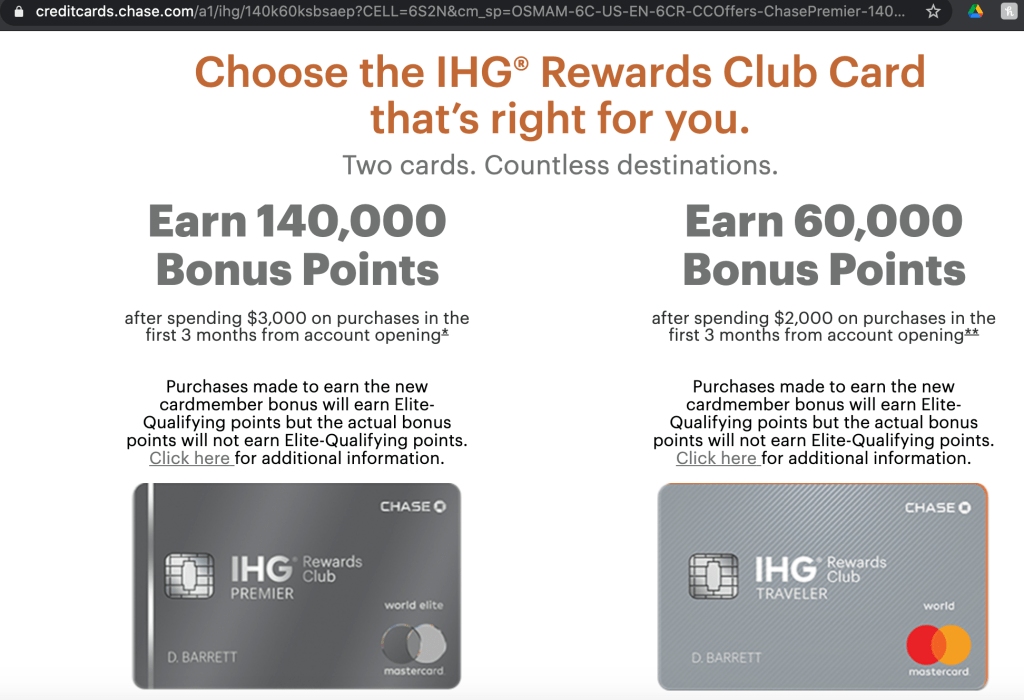

Then I Google “IHG credit card offers”. This is how I find out how many points I can earn by signing up for one of their travel rewards credit cards. At the time of publishing this post, I can earn 140,000 points as long as I meet the minimum spending requirement of $3,000 in the first 3 months. Assuming I shift all spending to this new card, or have a big purchase to make, the spending requirement can be easily achieved.

There are many other “perks” listed on their site about the card, but I don’t find many of them to be valuable except the 4th night free. If I stay at the same IHG hotel for 4 nights, I don’t have to use any points for the 4th night. This means I actually only need 87,500 IHG points for my 6 night trip. Since the sign-up bonus is for 140,000 points, I can either extend my stay to 10 nights (while only “paying” for 8) or go on a second trip.

One detail that I don’t find very important is the annual fee. Some of you might find that irresponsible, but hear me out. I don’t plan to keep this card for more than a year. I will open it, spend the minimum, immediately pay it off, book my reward travel, go on the trip, then close the card. In this case I’ll have stayed 10 nights for the $89 annual fee. That math works for me every time.

I usually repeat the previous steps with several different hotels to maximize the points. Be aware that different hotel chains have different point values. 140,000 IHG points is not equal to 140,000 Marriott points. In order to compare them, find out how many points each hotel requires per night. Then figure out how many nights the sign-up bonus covers. This is how to do an apples to apples comparison of points.

Of course, you don’t have to compare points at all. If you are happy with your selection and the sign-up bonus covers your plans, proceed!

Step 5: Apply for the Card and Meet Minimum Spend Requirements

After deciding on the destination and the hotel, I apply for the card. Usually I’ll receive an immediate message indicating I’ve been approved and the card will arrive at my house in about a week. Sometimes there’s a more thorough assessment of the application and it can take a few days to find out if I’ve been approved.

After receiving the card, I put this card in the primary slot in my wallet. All spending over the next 3 months will be done with this card to make sure I meet the minimum spend requirement. I also change my auto-pay for bigger recurring expenses to my new travel rewards credit card.

Once I’ve met the minimum spend requirement and paid it off, the points are immediately deposited to my account. Now I can book my trip! I go back to IHG’s website, enter my preferred dates and select “Rewards Nights” from the Rate Preferences drop down. Do this in conjunction with flight options so that you can minimize your total spend.

Step 6: Travel!

After booking the hotel and flight(s), the only thing left is to wait for the dates to roll around! Bring your card for incidentals and your confirmation number for check in. Everything works the same way as if you paid with dollars. Sometimes you’ll get a gift upon checking in, or some other little perk during your stay (bottled water, upgraded wifi).

Step 7: Close the Card

Upon returning home, I close the card. It has very little value since I don’t frequent IHG hotels on a very regular basis. I’m better off selecting a new travel rewards card where I can again collect a hefty sign-up bonus and travel for next to nothing. If I forget to close the card, I’ll only pay the annual fee assuming I don’t keep a balance on my card. Over time, the annual fee will eat into the savings I used on my rewards trip. This is bad math. Travel then close the card.

The Best Way to Travel

In this example I used hotel rewards points, but the same can be done for airline miles. Or you can go with a travel rewards credit card that isn’t tied to a particular hotel chain or airline. This is why the Chase Sapphire cards are so popular. Chase points are transferable to a number of partners (United Airlines, Southwest, Hyatt, Marriott, etc.) making it easy to spend them anywhere. Their points can also be used for car rentals. More on that another time.

Getting free nights and flights for money you already spend seems too good to be true. I don’t blame anyone for being wary of points. I was, too. But this is one of the rare cases where you can reap big rewards for little risk. And we’ve only scraped the surface.

So if you want to travel more for less, give it a shot. What do you have to lose?

Pingback: Plutus Awards Weekly Showcase: October 15, 2021 - The Plutus Foundation